In today's fast-paced business environment, having a solid financial strategy is more important than ever. Financial model templates serve as invaluable tools for entrepreneurs, analysts, and decision-makers looking to clarify their financial projections and assess the viability of their ideas. By offering structured formats for data analysis, these templates not only streamline the budgeting process but also enhance the accuracy of forecasts, allowing users to navigate financial uncertainties with greater confidence.

Whether you are a startup looking to attract investors or an established company seeking to optimize your financial planning, understanding how to leverage financial model templates can be a game changer. This guide will delve into the various types of templates available, their key components, and how they can unlock the potential for success in your financial endeavors. Get ready to elevate your financial strategy and make informed decisions that propel your business forward.

Types of Financial Model Templates

Financial model templates come in various forms, tailored to suit different purposes and industries. One common type is the three-statement model, which incorporates the income statement, balance sheet, and cash flow statement into a cohesive framework. This model allows users to analyze a company's financial health and performance, making it essential for investors and financial analysts seeking to understand the implications of business activities.

Another popular type is the discounted cash flow (DCF) model. This template focuses on estimating the value of an investment based on its expected future cash flows, discounted back to their present value. DCF models are frequently used in investment analysis and corporate finance, as they provide insights into whether an asset is undervalued or overvalued in the market. They are particularly useful in mergers and acquisitions, venture capital, and real estate investment decisions.

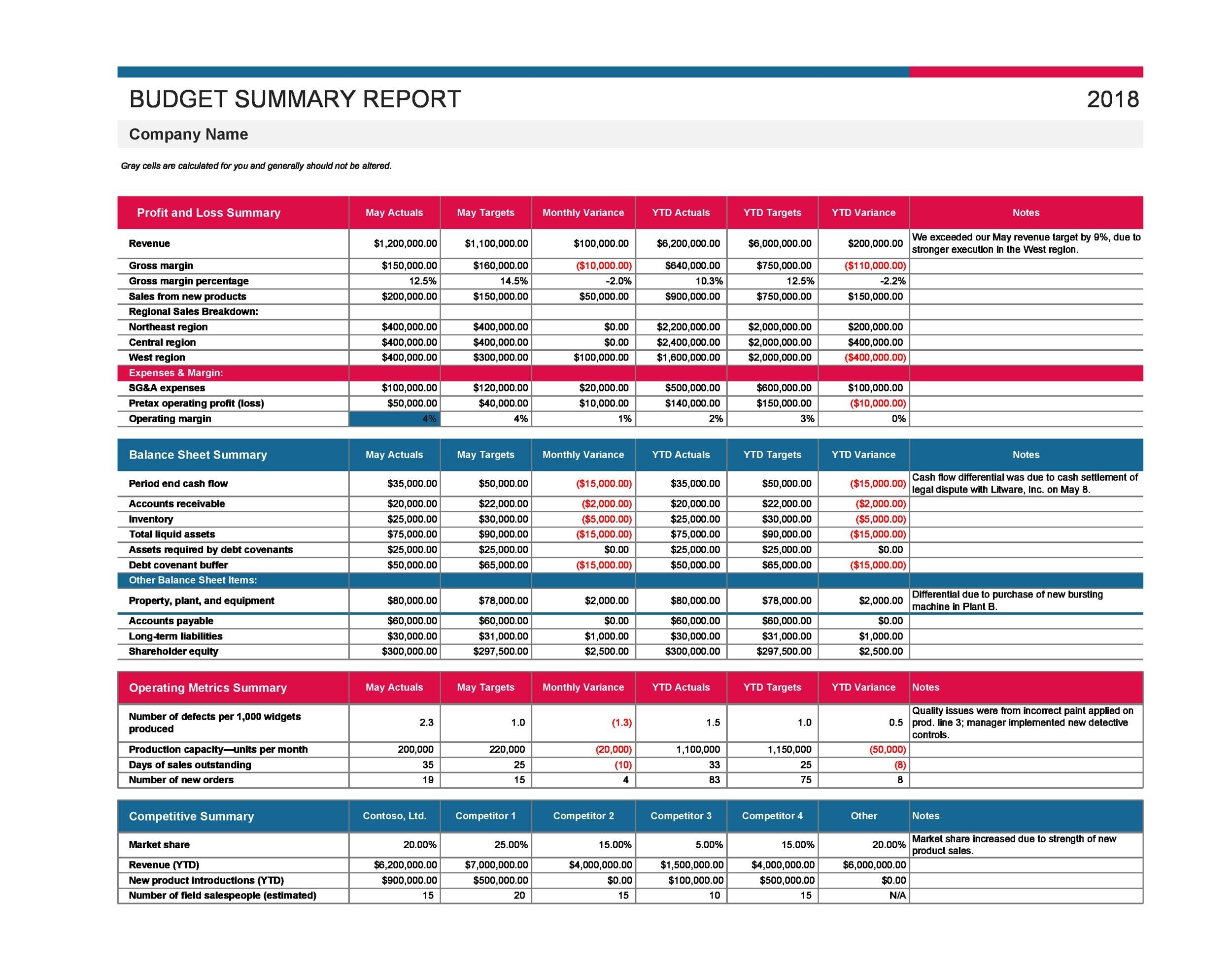

Lastly, the budget model template serves as a tool for organizations to plan and manage their finances effectively. By projecting revenues, expenses, and cash flows over a specific period, businesses can assess their financial sustainability and set realistic financial goals. This type of template is critical for startups and established companies alike, as it provides a roadmap for resource allocation and helps in identifying potential financial challenges ahead.

Key Components of a Financial Model

A robust financial model is built on a few key components that serve as the foundation for accurate forecasting and evaluation. First and foremost, assumptions play a crucial role, as they drive all the calculations within the model. These assumptions can include growth rates, cost structures, and revenue projections, all of which should be based on thorough market research and historical data. Clear documentation of these assumptions helps stakeholders understand the rationale behind the numbers and allows for better sensitivity analysis.

Another essential component is the income statement, which provides insights into the company’s profitability over a specified period. This statement typically includes revenues, expenses, and net income, enabling decision-makers to assess financial performance at a glance. A well-structured income statement integrates seamlessly with other financial statements, ensuring a holistic view of the business's financial health and making it easier to identify trends, cost drivers, and areas for improvement.

Lastly, the cash flow statement is crucial for understanding the liquidity and cash generation capacity of the business. This statement outlines cash inflows and outflows, highlighting how well the company can manage its cash to meet obligations and fund growth initiatives. By projecting future cash flows, businesses can prepare for potential shortfalls or surpluses, aiding in better financial planning and risk management. Together, these components form a comprehensive financial model that is essential for informed decision-making and strategic planning.

Best Practices for Using Financial Models

To maximize the effectiveness of financial model templates, it is essential to ensure clarity and simplicity in their design. A model should be easy to navigate, with clearly labeled sections and straightforward formulas. This aids in reducing errors and makes it simpler for stakeholders to understand the underlying assumptions and outcomes. By organizing the model logically, users can follow the flow of data and insights without becoming overwhelmed.

Regularly updating financial models is another critical practice. As market conditions and internal operations change, the assumptions within a model should be recalibrated to reflect these shifts. Establishing a routine for reviewing and adjusting key inputs can prevent outdated information from skewing results. This approach not only enhances accuracy but also keeps the model relevant and useful for decision-making.

Lastly, it is important to document all assumptions and methodologies used in financial models. Providing a commentary that outlines the reasoning behind key inputs and calculations fosters transparency and ensures others can easily follow your logic. This is particularly beneficial when sharing the model with team members or stakeholders, as it builds trust in the outputs and encourages collaboration on future iterations or enhancements.